Verisave Launches Comprehensive CEDP Compliance Solution as Merchants Face December Fee Shock

Firm releases expected impact analysis and makes compliance available as Visa enforcement deadline passes

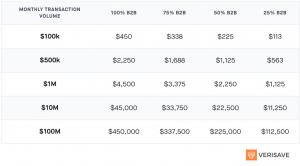

SALT LAKE CITY, UT, UNITED STATES, November 13, 2025 /EINPresswire.com/ -- Verisave, a merchant account cost-reduction and consulting firm specializing in credit card processing fee optimization, today announced the launch of Verisave Connect, a compliant solution designed to help B2B merchants maintain Verified Merchant status with Visa, and achieve Product 3 commercial interchange rates, under Visa's Commercial Enhanced Data Program (CEDP).The announcement comes as businesses begin to experience the financial impact of Visa's new requirements which came into effect on October 17, 2025. Verisave’s own analysis shows that non-compliant merchants stand to lose $4,500 for every $1 million processed in Visa commercial transactions. For example, a company processing $10 million per month in Visa B2B credit card volume will face up to $45,000+ in additional monthly interchange fees.

Announced in early 2025, Visa’s CEDP aims to reward merchants for providing thorough transaction details when processing business, fleet, and government credit card transactions. The transaction data helps to prevent fraud and, as a result, the merchant receives a significant interchange fee discount. CEDP replaces prior Level 2 and Level 3 processing programs, the intents of which were often bypassed via auto-fill or dummy data, rather than legitimate transaction data. CEDP tightens the data requirements and introduces Visa AI-assisted audits to ensure transaction details are legitimate.

"Businesses that have relied on their gateway or processor to submit fake data on their behalf to achieve Visa's interchange discounts have had this door slammed shut. Even those that were providing mostly accurate data in the past will find that they are not compliant with the more rigorous CEDP requirements. Businesses will really begin to feel the financial pain on their December statements — the first full billing cycle since enforcement began," said Jeremy Layton, CEO and founder of Verisave. "This will create an increase of up to 33% on their Visa B2B interchange fees. Companies that haven't achieved compliance are already bleeding cash."

Verisave Connect bridges the gap between the ERP or other invoicing system (where the CEDP compliant data resides) and the payment gateway, and automatically attaches the CEDP-compliant data to the transaction. The solution delivers 99.9% field-level compliance and guarantees Verified Merchant status with Visa.

The solution passes authentic transaction data designed to withstand Visa's AI-assisted audits. The platform is backed by Verisave's 25 years of interchange optimization expertise.

Verisave is also offering a complimentary personalized CEDP risk assessment to help businesses understand their exposure and estimate potential financial impact.

For more information or to request a free CEDP risk assessment, visit: verisave.com

Sam Barber

Pitchr.ai

+1 917-246-2775

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.